WEX (WEX)·Q4 2025 Earnings Summary

WEX Beats on Fuel Tailwind as ANI EPS Jumps 15%

February 5, 2026 · by Fintool AI Agent

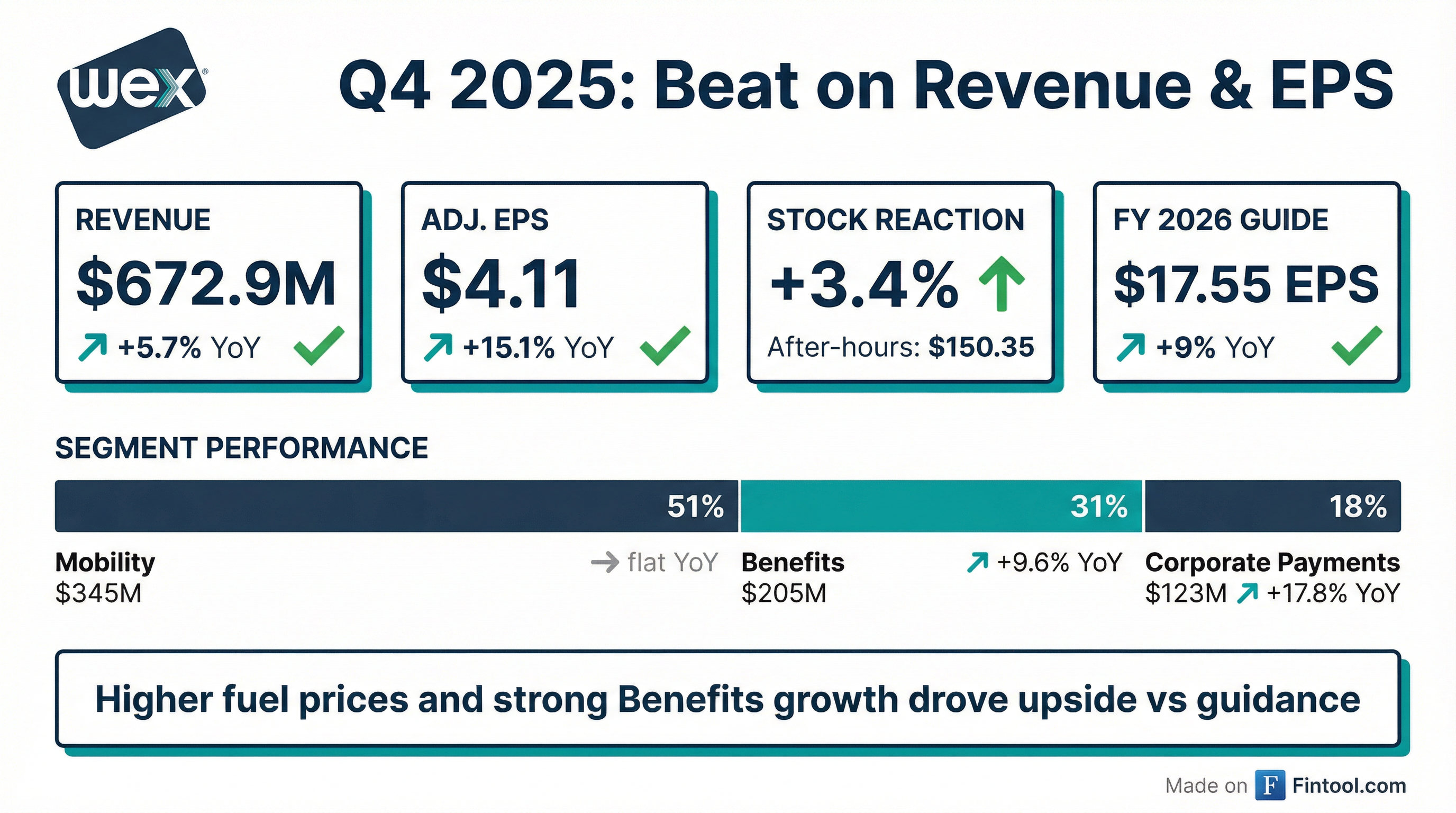

WEX Inc. delivered a solid beat in Q4 2025, with results coming in above the high end of guidance on both revenue and earnings. Higher-than-anticipated fuel prices and accelerating momentum in the Benefits segment drove the upside, while Corporate Payments posted its strongest growth quarter of the year at +17.8% YoY.

The stock responded positively, closing up 3.4% to $148.91 on earnings day—a notable reversal from the -6.1% and -6.9% drops following the prior two earnings releases.

Did WEX Beat Earnings?

Yes. WEX exceeded guidance on both revenue and adjusted EPS:

What drove the beat? Management attributed the upside to two factors:

- Fuel prices: The Q4 average domestic fuel price of $3.29/gallon was 20 cents higher than the guidance assumption, adding ~$10 million to revenue

- Benefits strength: The segment delivered 9.6% revenue growth with strong HSA account growth outpacing the market

When stripping out fuel and FX tailwinds, organic revenue growth was +4.5% and organic EPS growth was +12.1%.

Management described this as an inflection point where prior investments are translating into stronger performance: "Earnings growth accelerated, operating leverage improved, and we made tangible progress towards the margin expansion we expect as our investments continue to scale."

What Did the Segments Deliver?

Mobility (51% of Revenue)

The core fleet payments business was flat despite a fuel price tailwind, reflecting continued macro softness:

- Payment processing transactions declined 4.3% YoY

- North American local fleets down 4.4%, Over-the-Road trucking down 1.1%

- Credit losses rose to 15 bps of spend (vs. 11 bps in Q4 2024)

- Net interchange rate stable at 1.33%

Margin compression (-5 pts YoY) was driven by higher credit losses and increased investment in sales & marketing and product development.

Management highlighted 10-4 by WEX as an expansion into the underserved owner-operator segment, with negotiated truckstop discounts saving typical users "hundreds of dollars each month." December accounted for more than half of total Q4 volume on the platform.

Benefits (31% of Revenue)

The fastest-growing segment continues to outperform:

- Average SaaS accounts grew 6.0% YoY to 21.6 million

- HSA accounts now exceed 9.4 million, making WEX a top-5 HSA provider with ~20% market share

- Average custodial cash assets up 11.6% to $4.9 billion

- Custodial revenue of $61.0M (+14% YoY) benefited from higher interest yields (5.00%)

New AI-powered claims automation reduces processing times from days to minutes with 98% accuracy, supporting improved participant satisfaction and lower cost to serve.

Corporate Payments (18% of Revenue)

The standout performer this quarter:

- Purchase volumes up 16.9% driven by travel customer recovery

- Net interchange rate up 6 bps sequentially

- Direct AP business (20% of segment revenue) grew 15%+

- Segment adjusted operating margin expanded 4.5 pts to 48.4%

How Did the Stock React?

WEX closed up 3.4% to $148.91 on earnings day, with after-hours trading pushing shares to $150.35. This was a notable reversal from recent earnings reactions:

The positive reaction likely reflects:

- Results beating lowered expectations after the Q3 selloff

- 2026 guidance implying 9% EPS growth despite fuel headwinds

- Corporate Payments inflection showing sustainable recovery

At $148.91, WEX trades at 20% below its 52-week high of $186.78 reached in early February 2025.

What Did Management Guide for 2026?

WEX provided 2026 guidance implying continued underlying growth offset by macro headwinds:

Q1 2026 guidance:

- Revenue: $650-670M

- Adjusted EPS: $3.80-4.00

Key 2026 Guidance Assumptions

Fuel prices: Assumption of $3.10/gallon (vs. $3.32 in FY 2025) represents a 7% YoY decline, reducing revenue by ~$47M and EPS by ~$0.85.

By segment (excluding macro impacts):

- Mobility: 1-3% revenue growth; lower interest rates on merchant contracts (-1% headwind)

- Benefits: 5-7% revenue growth; ~2% headwind from lower rates on non-bank custodian business

- Corporate Payments: 5-7% revenue growth

Cost savings: $50M of cost actions identified; portion reinvested in growth initiatives (primarily product innovation), portion drops to margins

Margin impact: Adjusted operating margin expected flat YoY as ~75 bps of improvement from efficiencies is offset by ~75 bps drag from lower fuel prices

Share count benefit: The $750M tender offer (completed March 2025) continues to benefit EPS through Q1 before annualizing

What Changed From Last Quarter?

Improving Trends

- Corporate Payments acceleration: +17.8% growth vs. +4.7% in Q3, driven by travel recovery and direct AP wins

- Stock reaction: First positive earnings reaction since Q1 2024

- Cash flow generation: TTM adjusted free cash flow of $638M, up from $562M in FY 2024; expected to exceed $600M again in 2026

Ongoing Challenges

- Mobility volumes: Payment transactions down 4.3%, the fourth consecutive quarter of declines

- Credit quality: Credit losses at 15 bps, up from 11 bps YoY, within guidance but elevated

- Leverage: 3.1x net debt/EBITDA, above historical averages though within target range

Full Year 2025 Summary

The muted revenue growth reflects the fuel price headwind (-2% drag) and Corporate Payments OTA transition, while EPS growth was boosted by the $750M tender offer reducing share count by 4.9M shares.

Capital Allocation Update

WEX deployed $97M in Q4 2025:

- $38M in capital expenditures

- $59M on the BP portfolio acquisition

- $0 in share repurchases (prioritizing deleveraging)

Leverage trajectory: 3.1x at year-end, down from 3.5x at Q1 2025 peak. Management targets 2.5-3.5x range.

Debt runway: No maturities until 2028 ($1.35B Term A due), providing flexibility for opportunistic capital deployment.

Key Metrics to Watch

What Did Management Say About AI and Product Innovation?

WEX emphasized an "AI-first approach to product development" that increased product innovation velocity by more than 50% year-over-year while reducing the technology team by approximately 400 people.

Key product launches and AI initiatives:

On agentic AI in travel booking, CEO Melissa Smith noted that large OTAs are "effectively partnering with the AI platforms like OpenAI, like Google" rather than being disrupted, and virtual card payments are becoming "if anything more important" as automation increases.

Q&A Highlights

Credit Loss Drivers in Q1: CFO Jagtar Narula explained elevated Q1 credit loss guidance (17-22 bps vs. 12-17 bps full year) stems from two factors: (1) receivables originated when fuel prices were higher 6 months ago creating math headwinds as PPG declines, and (2) testing of credit offers in H2 2025 that didn't perform—now pulled from market.

Benefits Account Growth: Q1 expected at 5-7% YoY, with typical step-down from Q1 to Q2 due to new onboarding in Q1 and customer departures in Q2. The UAW contract accounts will continue—only the year-over-year comparison becomes harder after Q2 2025 laps.

Corporate Payments Cadence: Travel volumes expected to be "cleaner" and more normalized quarter-to-quarter now that the OTA transition is complete. Non-travel embedded payments and Direct AP will ramp through the year as new implementations go live.

Scheme Provider Incentives: WEX negotiated a new card network scheme relationship in H2 2025 that improved yields in Q3-Q4 and will provide favorable comps through H1 2026 before annualizing.

M&A Deferred Payments: Deferred and contingent M&A payments related to Benefits acquisitions will be "substantially completed" by end of Q1 2026, freeing up approximately $150 million of cash flow starting in 2027.

Board Governance Update

WEX announced the next phase of its multi-year board refreshment:

- David Foss (newly appointed director) will become Vice Chair and Lead Independent Director effective at 2026 annual meeting

- Shikhar Ghosh and Jack VanWoerkom will retire from the board at that time

- Board size will reduce to 10 directors

CEO Smith indicated the strategic review process with external bankers "validated the fact that the business is better off together and execution should be our focus."

What's Next?

Near-term catalysts:

- Q1 2026 earnings (late April/early May)

- BP portfolio conversion ramp (weighted to H2 2026)

- Open enrollment cycle results for Benefits business

Risks to monitor:

- Fuel price volatility (sensitivity: $0.10/gal = $20M revenue, $0.35 EPS)

- Continued Mobility volume softness—management assumes "no improvement in the macro environment"

- Elevated Q1 credit losses (17-22 bps guidance) before normalizing to 12-17 bps full year

Data sources: WEX Q4 2025 Earnings Supplement (Feb 4, 2026), S&P Global